Controlling Risk

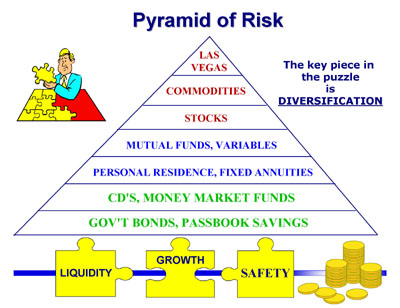

The Pyramid of Risk

A balanced financial plan always includes many facets. Building your financial home is no different than building a regular house. Start with the foundation. Ensure you have adequate emergency funds (enough to cover at least two months of bill payments). Have a strong debt reduction plan in place and ensure you have ample protection for your family and your assets (life, home, auto, & health insurance). Pay yourself first, if possible through a payroll deduction or allotment program. DIVERSIFICATION is always the key.

Another aspect of controlling risk is insurance. Drivers must have vehicle insurance, mortgage companies require fire insurance, and if you have a family you would be very remiss not to carry life insurance.

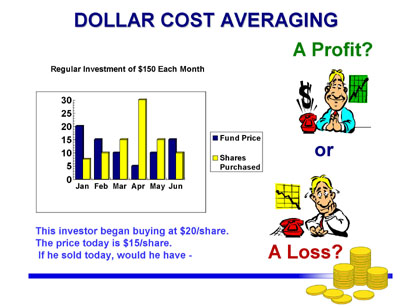

Your savings / investments can take many forms. The basics normally include some type of fixed interest rate program and investment in equities through a good mutual fund. A mutual fund offers the advantages of diversification, professional management, liquidity, and choice of objectives and some can be started for as little as $25/ month. The biggest killer of financial futures is PROCRASTINATION. Don't put off activating your financial plan. Once you start it, BE PERSISTENT. A wonderful example of the advantages persistency is Dollar Cost Averaging.

Dollar Cost Averaging

The answer to the question in the graphic above is that the investor would make a profit. The key to the chart is the yellow bars. As the investor continued to invest the same amount each month and the share prices fell during the February through March period, he /she would have been purchasing more shares, thus driving the average cost per share down. By the time the hypothetical sale is made in June, this investor would have made over $400 profit on the $900 invested. This strategy works best with a good mutual fund and better yet when continued for a period of at least 10 years.

Preparing for Retirement

Retirement Resources

Car Buying

Car Buying College Planning

College Planning Computer Safety

Computer Safety Discount Health Plans

Discount Health Plans Final Expense Insurance

Final Expense Insurance Consumer Tips

Consumer Tips Home Buying

Home Buying Home Insurance

Home Insurance Identity Theft

Identity Theft Prescriptions

Prescriptions Shopping

Shopping Travel

Travel Getting Started

Getting Started Debt Roll-Up

Debt Roll-Up Credit Reports

Credit Reports Credit Scores

Credit Scores Credit Repair

Credit Repair Growing Wealth

Growing Wealth Time Value of Money

Time Value of Money Controlling Risk

Controlling Risk Tax Planning

Tax Planning A Balanced Plan

A Balanced Plan Enlisted Pay

Enlisted Pay Officer Pay

Officer Pay Finding a Job

Finding a Job Relief Act

Relief Act Thrift Savings Plan

Thrift Savings Plan VA Education

VA Education VA Home Loans

VA Home Loans VA Health Care

VA Health Care VA Pension Benefits

VA Pension Benefits VGLI

VGLI