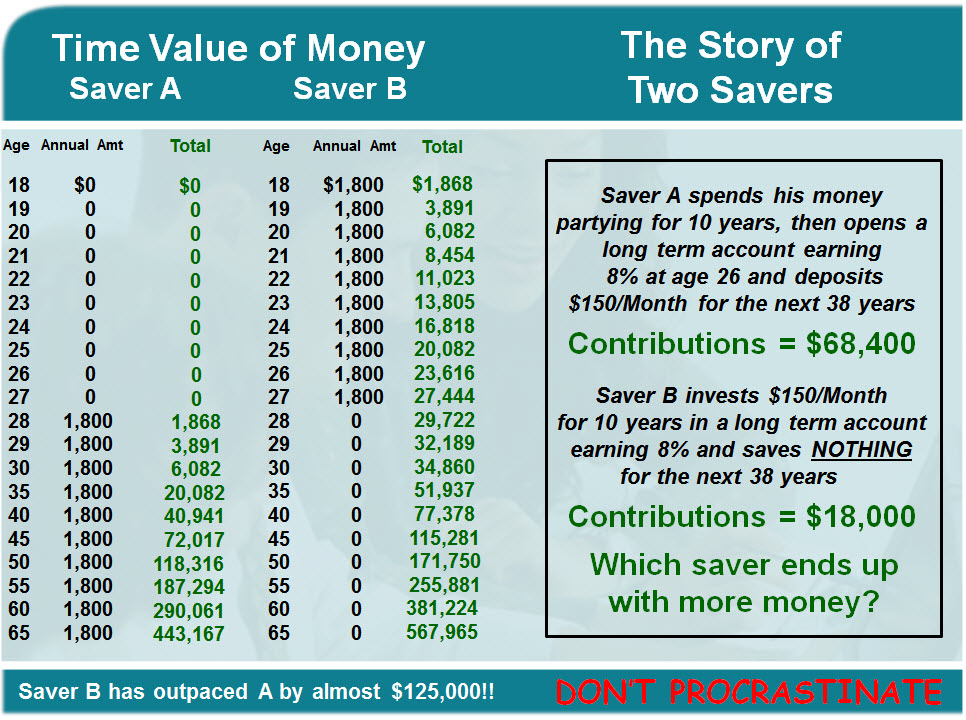

Time Value of Money

The Story of Two Savers

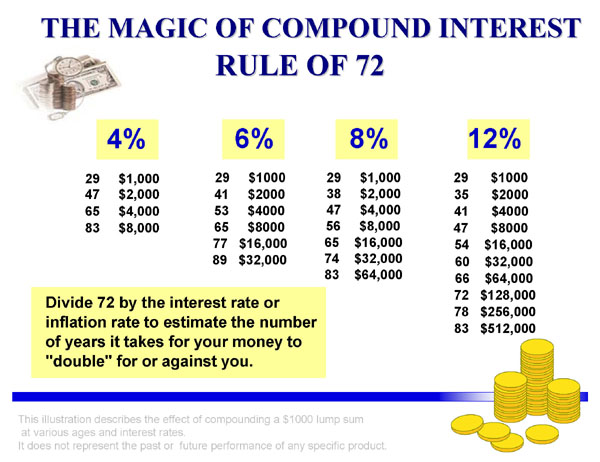

The key to the chart above is that Saver B did not wait to start his/her savings program. Even though the rate of return is historical, the principle remains the same. Because Saver B had an 10 year head start, Saver A was never able to catch up, even though Saver B stopping investing after age 27. That is one way of looking at the Rule of 72 and understanding the power of compounding and the importance of following a regular plan of saving and investing. Here is another example with the effects of different rates of return on a fixed sum of money:

The Rule of 72

How much do you need to save?

Click on the calculator above for the Rule of 72 Classroom Calculator

or use the general calculator below:

Car Buying

Car Buying College Planning

College Planning Computer Safety

Computer Safety Discount Health Plans

Discount Health Plans Final Expense Insurance

Final Expense Insurance Consumer Tips

Consumer Tips Home Buying

Home Buying Home Insurance

Home Insurance Identity Theft

Identity Theft Prescriptions

Prescriptions Shopping

Shopping Travel

Travel Getting Started

Getting Started Debt Roll-Up

Debt Roll-Up Credit Reports

Credit Reports Credit Scores

Credit Scores Credit Repair

Credit Repair Growing Wealth

Growing Wealth Time Value of Money

Time Value of Money Controlling Risk

Controlling Risk Tax Planning

Tax Planning A Balanced Plan

A Balanced Plan Enlisted Pay

Enlisted Pay Officer Pay

Officer Pay Finding a Job

Finding a Job Relief Act

Relief Act Thrift Savings Plan

Thrift Savings Plan VA Education

VA Education VA Home Loans

VA Home Loans VA Health Care

VA Health Care VA Pension Benefits

VA Pension Benefits VGLI

VGLI