Tax Planning

The Economic Value of Tax Planning

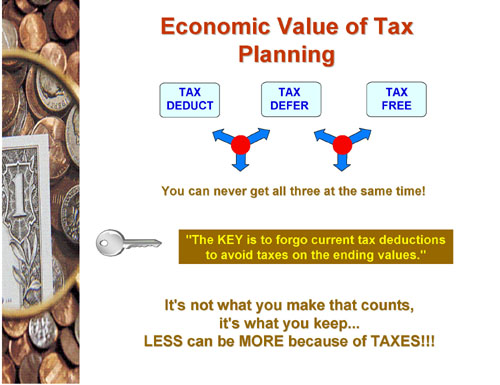

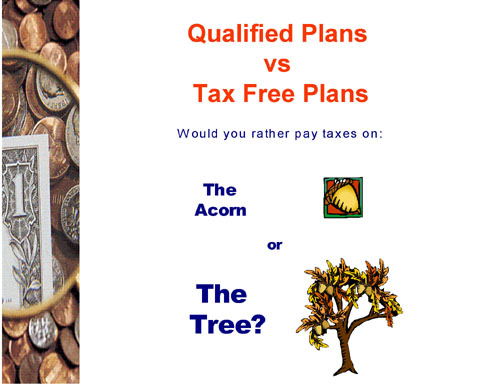

You've learned about safety, liquidity, and growth, but the wild card that can drastically effect your financial future is TAXES. You must understand the fact that there are three ways that most retirement accounts will be treated for tax purposes: TAX-DEDUCTIBLE, TAX-DEFERRED, or TAX-FREE. If an account is tax-deductible, it will normally be tax-deferred, but it will NEVER be tax-free. On the other hand, an account may be tax-free and tax-deferred, but will NEVER be tax-deductible. You can't ever receive all three in the same program. Understand the rules and build your plan accordingly to give you the maximum benefit. Know the difference between structures such as traditional & Roth IRA's. Take advantage of 401k plans with matching funds. Understand annuities, variable programs, and the difference between tax deductions & tax credits.

Tax Diversification

As always DIVERSIFICATION is the key, however, in this case we refer to TAX DIVERSIFICATION. Your emergency funds should always be in a taxable liquid account. Your retirement funds should not only be diversified between fixed income and equities, but also between qualified accounts (tax deductible and tax deferred, but fully taxable when withdrawn) and accounts which offer tax-free withdrawal at retirement, such as a ROTH IRA.

Make sure you read the special Retirement Tips page and discover the dirty little secrets about your retirement accounts.

Calculate the Effect of Taxes

50% Cheaper Tax Filing

Car Buying

Car Buying College Planning

College Planning Computer Safety

Computer Safety Discount Health Plans

Discount Health Plans Final Expense Insurance

Final Expense Insurance Consumer Tips

Consumer Tips Home Buying

Home Buying Home Insurance

Home Insurance Identity Theft

Identity Theft Prescriptions

Prescriptions Shopping

Shopping Travel

Travel Getting Started

Getting Started Debt Roll-Up

Debt Roll-Up Credit Reports

Credit Reports Credit Scores

Credit Scores Credit Repair

Credit Repair Growing Wealth

Growing Wealth Time Value of Money

Time Value of Money Controlling Risk

Controlling Risk Tax Planning

Tax Planning A Balanced Plan

A Balanced Plan Enlisted Pay

Enlisted Pay Officer Pay

Officer Pay Finding a Job

Finding a Job Relief Act

Relief Act Thrift Savings Plan

Thrift Savings Plan VA Education

VA Education VA Home Loans

VA Home Loans VA Health Care

VA Health Care VA Pension Benefits

VA Pension Benefits VGLI

VGLI