The Debt Roll-Up Strategy

Finding Accelerator Dollars

Accelerator dollars are any money you can identify during the budget process that can be captured from any variable or discretionary expense category. They are the key to the Debt Roll-Up Strategy. There are literally thousands of ways to find accelerator dollars. It can also be money saved on one-time purchases. This is the time to become very creative. See how many more ideas you can add to our list:

- Examine every purchase - is it a "need" or a "want"?

- Consider buying a 2-year or older vehicle

- Perform "plastic surgery" on your credit cards

- NEVER buy credit life insurance

- Think twice about purchasing extended warranties or after-market services/products

- Use coupons and join a free online shopping rebate service

- Cut back on fast food and other indulgences

- Cut back on other indulgences

- Have a world-wide garage sale

- Spend less on dental, doctor, and other health expenses with health discount programs

- Don't give the government a free loan (check your W-4 for unclaimed exemptions)

- Find a part-time job

- Develop a second income on the web

- How many more ideas can you add?

- For more ideas on saving money and finding accelerator margin, view the 66 Ways to Save Money booklet

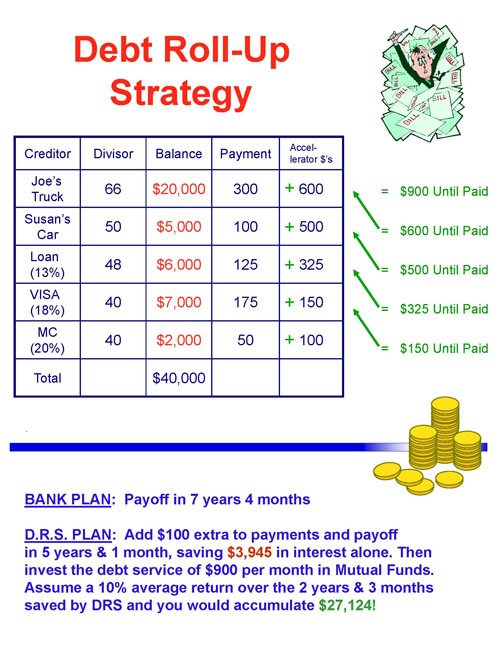

Cut Down Your Bills With The Debt Roll-Up Strategy

Revolutionize your entire financial future by organizing , prioritizing, and attacking your debts in a systematic manner. If you have the discipline to stick with this plan, you can pay off your debts in a significantly shorter time. If emergencies occur, readjust the plan, but NEVER, NEVER QUIT. Half the battle is establishing a positive mental attitude. If you established meaningful goals, here is where they help to keep you on track.

- Take all your bills that have a balance that can be paid off and divide each balance by the minimum monthly payment required by each creditor. This will give you a number to assign to each bill.

- List all your bills starting with the highest number on the top going down to the lowest number. If two bills have the same number, list the one with the highest interest rate closer to the bottom.

- If you were paying over the minimum balance on any bill(s), take the extra amount and add it to your accelerator dollars.

- Take the accelerator dollars and add them to the minimum payment of the bill at the bottom of your list. This will be the bill you can pay off the quickest.

- As soon as that bill is paid in full, celebrate, and immediately ROLL-UP the entire amount you were paying on that bill to the next highest bill on the list. You now have new, larger accelerator dollars. Repeat the process each time a bill is paid.

- If you are not able to do this on your own, there are numerous non-profit organizations, which will take over the process for you. You pay them one payment each month and they in turn pay each one of your creditors and apply a forced debt roll-up strategy. Naturally, a fee is charged for this service. An advantage to the non-profit organization is that they are able to also negotiate with creditors for lower interest rates and easier payment schedules.

- If the expenses still equal or exceed the income it's time for you to seek the advice of a credit counselor.

Car Buying

Car Buying College Planning

College Planning Computer Safety

Computer Safety Discount Health Plans

Discount Health Plans Final Expense Insurance

Final Expense Insurance Consumer Tips

Consumer Tips Home Buying

Home Buying Home Insurance

Home Insurance Identity Theft

Identity Theft Prescriptions

Prescriptions Shopping

Shopping Travel

Travel Getting Started

Getting Started Debt Roll-Up

Debt Roll-Up Credit Reports

Credit Reports Credit Scores

Credit Scores Credit Repair

Credit Repair Growing Wealth

Growing Wealth Time Value of Money

Time Value of Money Controlling Risk

Controlling Risk Tax Planning

Tax Planning A Balanced Plan

A Balanced Plan Enlisted Pay

Enlisted Pay Officer Pay

Officer Pay Finding a Job

Finding a Job Relief Act

Relief Act Thrift Savings Plan

Thrift Savings Plan VA Education

VA Education VA Home Loans

VA Home Loans VA Health Care

VA Health Care VA Pension Benefits

VA Pension Benefits VGLI

VGLI